· Strategic Advantage Profile(SAP)

The strategic advantage profile is a tool for making

a systematic evaluation of the enterprises internal factors which are

significant for the company in its environment. The SAP shows the strengths and

weakness of an organization in different functional areas.

The inherent potential

of a firm to take advantage of its strengths and overcome its weakness, in

order to avail the opportunities provided and face the threats that are given

by the external environment, this capacity factor of an organization is called

the corporate capability factors, strategic factors, strategic advantage

factors and corporate competence factors. Strategic advantages are the outcome

of organizational capabilities. The result of these organizational activities

leads to rewards in terms of financial parameters such as profit or shareholder

value and non financial rewards such as market share or reputation. On the

other hand the penalties in the form of market share loss or financial loss is

called the strategic disadvantages. Strategic advantages can be measured by

using the parameters in which they are expressed like higher the profitability

better is the strategic advantage. Within the internal environment of an

organization different types of capability factors exists, these capability

factors of an organization are divided into different functional areas such as

Financial, Marketing, Operations, Personnel, Information Management and General

Management of the organization

The

strategist should look to see if the firm is stronger in these factors than its

competitors. When a firm is strong in the market, it has a strategic advantage

in launching new products or services & increasing market share of present

products & services. There are generally 5 functional areas in most of the

organizations. These areas are:-

✓ Marketing and

Distribution

✓ R & D and

Engineering

✓ Production and

Operations management

✓ Corporate resources

and personnel

✓ Finance and Accounting

1]

Strategic advantage factors: Marketing and Distribution

1.

Efficient and effective market research system

2.

The product service mix: quality of product and service and service

3.

Strong new - product and new- service leadership

4.

Patent protection (or equivalent legal protection for life)

5.

Positive feeling about the firm and its products and services on the part of

the ultimate consumer

6.

Efficient and effective packaging of products (or the equivalent for service)

7.

Effective pricing strategy for products and services

8.

Efficient and effective marketing promotion activities other than advertising

9.

Efficient and effective service after purchase

10.

Efficient and effective channel of distribution and geographical coverage,

including internal efforts.

2]

Strategic advantage factors: R & D and Engineering

1.

Basic research capabilities within the firm

2.

Excellence in product design

3.

Excellence in process design and improvement

4.

Superior packaging development being created

5.

Improvement in the use of old or new materials

6.

Ability to meet design goals and customer requirements

7.

Trained and experienced technicians and scientists

8.

Work environment suited to creativity and innovation

9.

Well – equipped laboratories and testing facilities

3]

Production and Operations management [ for 3, 4 & 5 refer OCP]

4]

Corporate resources and personnel

5]

Finance and Accounting

A

picture of the more critical areas which can have a relationship of the

strategic posture of the firm in the future.

PROFILE

OF SAP

A

concise chart of strategic advantage profile is prepared on the basis of

detailed information presented in the functional area profile. The strategic

advantage profile is a tool for making a systematic evaluation of the

enterprises internal factors which are significant for the company in its

environment. The SAP shows the strengths and weakness of an organization in

different functional areas.

Difference between the OCP &

SAP

The

outcome of the organizational capabilities is the strategic advantage. These

outcome of organizational capabilities are measured in terms of financial

parameters such as profit or shareholder’s value and non- financial parameters

like market share and reputation. On the other hand the disadvantages in the

form of loss and damage to market share are categorized into strategic

disadvantages. By using the parameters in which they are expressed, strategic

advantage are expressed in absolute terms like higher the profitability better

is strategic advantage of an organization. In order to compare the strategic

advantage over a period of time, an organization’s performance over a period of

time and its current performance with respect to its competitors in the

industry are used. So competitive advantage is a special case of strategic

advantage where the rewards or penalties could be measured against one or more

identified rivals in the industry. Thus the competitive advantage could be to

outperform its rivals in profitability or market standing. Competitive

advantage is measured and compared with respect to the competitors in the

industry so competitive advantage is a relative term rather than absolute. So

we can conclude that strategic advantage is a broader concept while competitive

advantage is one of its subset and strategic advantage is measured in absolute

term whereas competitive advantage in broader terms.

· BCG growth –Share matrix

BCG

Matrix is a matrix of Growth rate of the industry and Market share.

·

Growth

rate of the industry

-

Percentage

(%) of increase in sales

·

Market

share

-

Relative

market share of a firm = Market share in industry/market share of the largest

other competitor

i.

>

1 indicates market leader

Assumption

: Other things equal - growing market is attractive

Line

separating high & low competition position set at 1.5 times (needed to have

dominant position & to be called as star/cash cow),

A

product is indicated by circle; Area of circle significance to company - in

terms of assets used/sales

Similar

to product life cycle

Star

-

Market leader, peak of product life cycle, enough cash to maintain high share

(market), Growth rate slow

-

Becomes cash cows, More resources

-

Investment to support high growth No immediate profits

-

Great potential

-

Future Medium risk category

Question Marks - (Problem children/wild cats)

-

New products with potential for success

-

More resources but future uncertain

-

high risk category Money taken from mature products & spent on ? Slow

growth dogs

Cash cows

-

more money than needed for maintaining market share

-

Declining stage of life cycle Cash milked from for investment in ? Higher

profit

Dogs

-

Weak market share, low growth market cash trap of the company Identify Issues

-

current position & future position without change in the strategy

Goal

The goal

of BCG analysis is help firms to have a balanced portfolio

-

Maintain balanced portfolio

-

self sufficient in cash

Limitations

BCG

matrix may not identify business with profitable market share and ignores

factors beyond market leader.

-

Low share business may also be profitable market share

-

relative to one (market leader/competition) other factors that determine

success

· GE PORTFOLIO MATRIX

Industry

attractiveness

Company’s

business strengths/Competitive position

Industry attractiveness - market growth rate, industry

profitability, size, pricing practices, opportunities/ threats

scale 1

- 5 Very unattractive to very attractive

Business strengths - Market share, technological

position, profitability, size, strengths & weakness

scale

1-5, 1- very weak, 5 - very strong

Product line - a letter, circle - area -

(size - scales) pie - market share

Identify performance group - current & projected

portfolio without any change in strategy

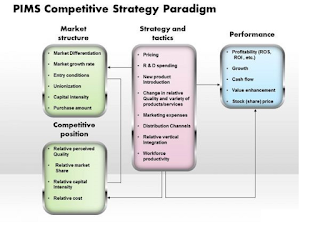

· Profit Impact of Market Strategy (PIMS)

The

Profit Impact of Market Strategies (PIMS) is a comprehensive, long-term study

of the performance of strategic business units (SBUs) in thousands of companies

in all major industries. The

Profit Impact of Market Strategy (PIMS) is a project that uses

empirical data to determine which business strategies make the difference

between success and failure. It is used to develop strategies for resource

allocation and marketing.

In the 1960s, General Electric came up with PIMS as an objective

approach to analyzing and learning from the great corporate performance. PIMS began as an internal project at General Electric (GE)

in 1960. Fred Borch, then a marketing vice-president and later the CEO,

initiated a project to quantify what factors led to success in GE´s diverse

businesses, from toasters to turbines, with sales already at $4 billion and

expected to more than double in a decade. (They did.) The original computer

model, which took five years to develop, was named PROM: Profitability Optimization Model. The data include information on markets, competitors,

quality, structure, environment and financial performance. Cross-sectional

regression analysis is a favored technique for verifying an hypothesis.

From 1972 to 1974 the on-going research was organized

as a project at Harvard Business School, giving birth to the Strategic Planning

Institute, SPI. At the beginning of 1974 the PIMS project was organized as an

independent non-profit organization, the Strategic Planning Institute. By

the middle 1980s the PIMS model had 400 items of information drawn from a

minimum of four years of operative and competitive information on 2,700

strategic business units (sbu´s). On the basis of this research, SPI could then

run scenarios for clients by entering different assumptions into the PIMS

computer model.

Since then, SPI researchers and consultants have continued working on the

development and application of PIMS data. According to the SPI, the PIMS

database is- "a collection of statistically documented experiences drawn

from thousands of businesses, designed to help understand what kinds of

strategies (e.g. quality, pricing, vertical integration, innovation,

advertising) work best in what kinds of business environments. The data

constitute a key resource for such critical management tasks as evaluating

business performance, analyzing new business opportunities, evaluating and

reality testing new strategies, and screening business portfolios.” The main

function of PIMS is to highlight the relationship between a business's key

strategic decisions and its results. Analyzed correctly, the data can help

managers gain a better understanding of their business environment, identify

critical factors in improving the position of their company, and develop

strategies that will enable them to create a sustainable advantage.

PIMS makes use of a unique library or database which keeps

expanding to this day and will continue to do so. The database comprises

cross-sectional and time-series data on approximately 4000 businesses collected

from more than 500 firms, big and small.

The information is built over a collection of 200 data items in

a standardized format, covering:

• The environment in

which the business operates

• The size of the target audience and the number of customers

• Market growth rates

• Channels of distribution

• Competitive position in the market

• Product/service price, quality, and costs involved

• Overall annual financial and operating performance

A key initial finding was that market share was a major driver to profitability. PIMS principles are taught in business schools, and the data are widely used in academic research. As a result, PIMS has influenced business strategy in companies around the world

The Strategic Planning Institute offers its PIMS model

(Profit Impact of Market Share) to clients to assist them in forming

strategy on the basis of empirically tested hypotheses. One runs split tests

and scenarios against the historical data in the PIMS database.

SPI

uses multi dimensional cross-sectional regression studies of profitability of

more than 4000 businesses. It then develops industry characteristics, Business

Average Profitability, and compares it with performances in the concerned

company

The most important factor to

emerge from the PIMS data is the link between profitability and relative market

share. PIMS found (and continues to find) a link between market share and the

return a business makes on its investment. The higher the market share – the

higher the return on investment. This is probably as a result of economies of

scale. Economies of scale due to increasing market share are particularly

evident in purchasing and the utilisation of fixed assets.

Profitability

is closely linked with market share.

A

10% improvement in profitability is linked with 5% improvement in Return on

Investment

When

to use PIMS

For small to

medium business operators, PIMS can be used to validate

your specific investment and expenditure strategies.

By analyzing the hordes of

evidenced data contained in the PIMS database, you can derive bulletproof

strategies to optimize the profitability of your business and encourage steady

growth.

Marketing managers can use

PIMS to understand their business environment and react to it accordingly. PIMS is used to develop and

test strategies for taking reliable financial measures.

Using its database, you

can identify critical strategic factors that will enable your business to

achieve a better, as well as a sustainable position in the market.

One can also:

• Determine the company’s future direction

• Recognize competitors and evaluate potential acquisitions

• Measure benchmark performance levels.

Strategic positioning is the chief determining factor

of business success.

No comments:

Post a Comment