Change

management addresses the people side of change. Creating a new organization,

designing new work processes, and implementing new technologies may never see

their full potential if you don't bring your people along. That's because

financial success depends on how thoroughly individuals in the organization

embrace the change.

Change

management is the application of a structured process and set of tools for

leading the people side of change to achieve a desired outcome. Ultimately,

change management focuses on how to help people engage, adopt and use a change

in their day-to-day work.

When

defining change management, we recognize it as both a process and a

competency.

Change Management as a Process

The

change management process enables practitioners within organizations to

leverage and scale the change management activities that help impacted

individuals and groups move through their transitions.

There

are numerous models for managing a change process. Two models that are particularly

well-known and useful in understanding strategic change management are Kurt

Lewin's Change Model and John Kotter's Change Model.

Kurt Lewin's Change Model (1947)

Kurt Lewin developed a change

model involving three steps: unfreezing, changing and refreezing.

The model represents a very simple and practical model for understanding the

change process. For Lewin, the process of change entails creating the

perception that a change is needed, then moving toward the new, desired level

of behavior and finally, solidifying that new behavior as the norm. The model

is still widely used and serves as the basis for many modern change models.

Unfreezing

Before you can cook a meal that has been

frozen, you need to defrost or thaw it out. The same can be said of change.

Before a change can be implemented, it must go through the initial step

of unfreezing. Because many people will naturally resist change,

the goal during the unfreezing stage is to create an awareness of how the

status quo, or current level of acceptability, is hindering the organization in

some way. Old behaviors, ways of thinking, processes, people and organizational

structures must all be carefully examined to show employees how necessary a

change is for the organization to create or maintain a competitive advantage in

the marketplace. Communication is especially important during the unfreezing

stage so that employees can become informed about the imminent change, the

logic behind it and how it will benefit each employee. The idea is that the

more we know about a change and the more we feel it is necessary and urgent,

the more motivated we are to accept the change.

Changing

Now that the people are 'unfrozen' they

can begin to move. Lewin recognized that change is a process where the

organization must transition or move into this new state of being. This changing step,

also referred to as 'transitioning' or 'moving,' is marked by the

implementation of the change. This is when the change becomes real. It's also,

consequently, the time that most people struggle with the new reality. It is a

time marked with uncertainty and fear, making it the hardest step to overcome.

During the changing step people begin to learn the new behaviors, processes and

ways of thinking. The more prepared they are for this step, the easier it is to

complete. For this reason, education, communication, support and time are

critical for employees as they become familiar with the change. Again, change

is a process that must be carefully planned and executed. Throughout this

process, employees should be reminded of the reasons for the change and how it

will benefit them once fully implemented.

Refreezing

Lewin called the final stage of his change

model freezing, but many refer to it as refreezing to

symbolize the act of reinforcing, stabilizing and solidifying the new

state after the change. The changes made to organizational processes, goals,

structure, offerings or people are accepted and refrozen as the new norm or

status quo. Lewin found the refreezing step to be especially important to

ensure that people do not revert back to their old ways of thinking or doing

prior to the implementation of the change. Efforts must be made to guarantee

the change is not lost; rather, it needs to be cemented into the organization's

culture and maintained as the acceptable way of thinking or doing. Positive

rewards and acknowledgment of individualized efforts are often used to

reinforce the new state because it is believed that positively reinforced

behavior will likely be repeated.

Some argue that the refreezing step is

outdated in contemporary business due to the continuous need for change. They

find it unnecessary to spend time freezing a new state when chances are it will

need to be reevaluated and possibly changed again in the immediate future.

However - as I previously mentioned - without the refreezing step, there is a

high chance that people will revert back to the old way of doing things. Taking

one step forward and two steps back can be a common theme when organizations

overlook the refreezing step in anticipation of future change.

Kotter's

Change Model (1995):

This model advocates that companies lead employees through eight critical

steps. The eight steps include:

- Establishing

a sense of urgency, or making sure that there is a need for the change and

that people understand that need

- Creating

a guiding coalition of supporters that can help model the new change and

work well together as a team

- Developing

both vision and strategy, a 'picture' of where the company is going and

the steps for how to get there

- Communicating

that vision to employees in a way that is easy to understand

- Empowering

employees throughout the company to act on making the change possible

- Generating

short-term wins or small celebrations along the way to celebrate and

encourage success

- Consolidating

what is learned from the current change to help the company improve the change

process in the future

- Anchoring the change in the corporate culture through strategies, such as making clear links to performance, profit, and customer satisfaction

The concept of change management dates back to the early to

mid-1900s. Kurt Lewin’s 3-step model for change was developed in the 1940s;

Everett Rogers’ book Diffusion of Innovations was published in 1962, and

Bridges’ Transition Model was developed in 1979. However, it wasn’t until the

1990s that change management became well known in the business environment, and

formal organizational processes became available in the 2000s.

Operationalizing your strategy takes discipline and focus. Organizations undergoing restructuring, merger integrations, or transformation need to think through implementation implications and risks at three levels – organizational, team, and individual. Each level presents unique implementation challenges. Driving a new strategy without a thorough execution plan frequently leaves organizations falling short of their intended results. Often, senior teams do not translate the broader strategic objectives into operational plans. Even more challenging is gaining broad organizational buy-in and alignment. Good strategies fail when organizational commitment is weak or non-existent.

Translating

your strategy into reality by bridging the gap between the new strategy and the

desired outcomes starts by clarifying

the operational impact of your strategy as it cascades down through your

organization.

Significance of Change Management

Major organizational change can be challenging. It often requires many levels of cooperation and may involve different independent entities within an organization. Developing a structured approach to change is critical to help ensure a beneficial transition while mitigating disruption especially when undergoing strategic change due to:

· Organizational Restructuring

· Merger integration

· Scaling for Growth

· Downsizing/Consolidation

· New Group Design

· Market Access Redesign

· Field Force Expansions

· Enterprise-wide Initiatives

Benefits for top management from change management:

· Translate leadership strategy into clear execution plans

· Develop implementation cascades with “turn key” roll-out materials, tools, and solutions

· Determine business risks and impact; develop risk mitigation strategies

· Link Human Capital processes and tools to drive specific behavior change and improve performance

· Define and track progress against success metrics

· Use effective change management strategies to gain commitment and alignment from all stakeholders

Change management is defined as the methods and manners in which a company describes and implements change within both its internal and external processes. This includes preparing and supporting employees, establishing the necessary steps for change, and monitoring pre- and post-change activities to ensure successful implementation.

· Transitional Change: These are the changes performed by the project managers or the high-level officials to steer the company away from one direction into another to make sure that the problem that the company is facing, is solved. These included mergers, automation, and acquisitions.

· Developmental Change: Any changes that are made in the company’s policies or in the project development processes to make sure that the already established processes be optimized and improved.

· Transformational Change: These changes are the most impactful as they change the fundamental concepts on which the company is based, and also the operations and the core values that the company holds dear.

Changes usually fail for human reasons: the promoters of the

change did not attend to the healthy, real and predictable reactions of normal

people to disturbance of their routines. Effective communication is one of the

most important success factors for effective change management. All involved

individuals must understand the progress through the various stages and see

results as the change cascades.

These 7 R’s of change management checklist consists of 7 simple questions. These questions are as follows.

1. The REASON behind the change?

2. RISKS involved in the requested change?

3. RESOURCES required to deliver the change?

4. Who RAISED the change request?

5. RETURN required from the change?

6. Who is RESPONSIBLE for creating, testing, and implementing the change?

7. RELATIONSHIP between suggested change and other changes?

If you have reasonable answers , yo are ready to pursue the change execution.

The organization is constantly experiencing change, whether caused by

new technology implementations, process updates, compliance initiatives,

reorganization, or customer service improvements, change is constant and

necessary for growth and profitability. A consistent change management process

will aid in minimizing the impact it has on your organization and staff.

Below given is 8 essential steps to ensure your change initiative is

successful.

1. Identify What Will Be

Improved

Since most change occurs to improve a process, a product, or an outcome, it is

critical to identify the focus and to clarify goals. This also involves

identifying the resources and individuals that will facilitate the process and

lead the endeavor. Most change systems acknowledge that knowing what to improve

creates a solid foundation for clarity, ease, and successful implementation.

2. Present a Solid Business

Case to Stakeholders

There are several layers of stakeholders that include upper management who both

direct and finance the endeavor, champions of the process, and those who are

directly charged with instituting the new normal. All have different

expectations and experiences and there must be a high level of

"buy-in" from across the spectrum. The process of onboarding the

different constituents varies with each change framework, but all provide plans

that call for the time, patience, and communication.

3 .Plan for the Change

This is the "roadmap" that identifies the beginning, the route to be

taken, and the destination. You will also integrate resources to be leveraged,

the scope or objective, and costs into the plan. A critical element of planning

is providing a multi-step process rather than sudden, unplanned

"sweeping" changes. This involves outlining the project with clear

steps with measurable targets, incentives, measurements, and analysis. For

example, a well-planed and controlled change management process for

IT services will

dramatically reduce the impact of IT infrastructure changes on the business.

There is also a universal caution to practice patience throughout this process

and avoid shortcuts.

4. Provide Resources and Use

Data for Evaluation

As part of the planning process, resource identification and funding are

crucial elements. These can include infrastructure, equipment, and software

systems. Also consider the tools needed for re-education, retraining, and

rethinking priorities and practices. Many models identify data gathering and

analysis as an underutilized element. The clarity of clear reporting on

progress allows for better communication, proper and timely distribution of

incentives, and measuring successes and milestones.

5. Communication

This is the "golden thread" that runs through the entire practice of

change management. Identifying, planning, onboarding, and executing a good

change management plan is dependent on good communication. There are

psychological and sociological realities inherent in group cultures. Those

already involved have established skill sets, knowledge, and experiences. But

they also have pecking orders, territory, and corporate customs that need to be

addressed. Providing clear and open lines of communication throughout the

process is a critical element in all change modalities. The methods advocate

transparency and two-way communication structures that provide avenues to vent

frustrations, applaud what is working, and seamlessly change what doesn't work.

6. Monitor and Manage

Resistance, Dependencies, and Budgeting Risks

Resistance is a very normal part of change management, but it can threaten the

success of a project. Most resistance occurs due to a fear of the unknown. It

also occurs because there is a fair amount of risk associated with change – the

risk of impacting dependencies, return on investment risks, and risks

associated with allocating budget to something new. Anticipating and preparing

for resistance by arming leadership with tools to manage it will aid in a

smooth change lifecycle.

7. Celebrate Success

Recognizing milestone achievements is an essential part of any project. When

managing a change through its lifecycle, it’s important to recognize the

success of teams and individuals involved. This will help in the adoption of

both your change management process as well as adoption of the change itself.

8. Review, Revise and

Continuously Improve

As much as change is difficult and even painful, it is also an ongoing process.

Even change management strategies are commonly adjusted throughout a project.

Like communication, this should be woven through all steps to identify and

remove roadblocks. And, like the need for resources and data, this process is

only as good as the commitment to measurement and analysis.

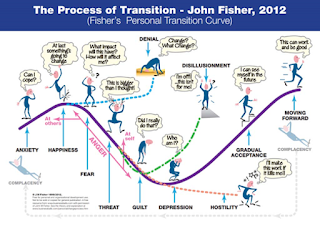

Once the strategist is sure about the awareness level as shown in above diagram, the journey is comfortable. And people skill is the top priority in this role.